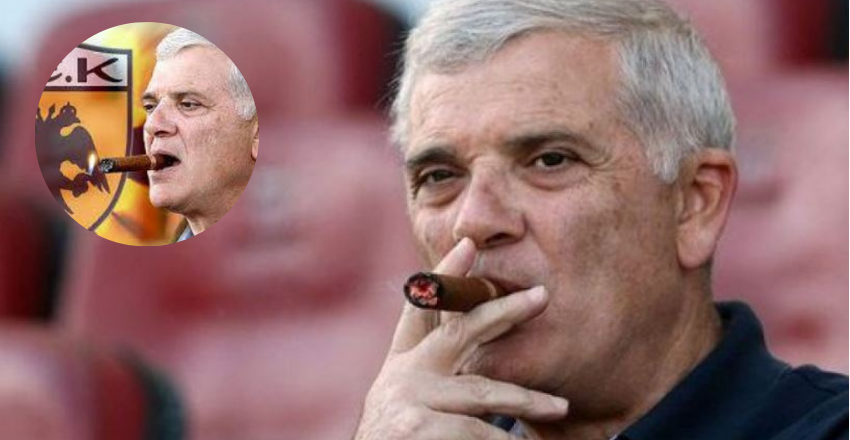

Greek businessman Dimitris Melissanidis is thought to be worth $3.4 billion. Renowned among Greece’s most successful businessmen, he has ventured in shipping, oil, and sports. He has had a long-lasting influence in several sectors and ranks sixth among the richest Greeks.

Dimitris Melissanidis: Bio Data and Profile

| Category | Details |

|---|---|

| Full Name | Dimitris Melissanidis |

| Date of Birth | March 8, 1951 |

| Age | 73 |

| Nationality | Greek |

| Net Worth | $3.4 billion |

| Primary Ventures | Aegean Oil, Aegean Shipping Enterprises |

| Key Roles | Former President of AEK Athens F.C. |

| Achievements | Lloyd’s List Top 100 Influential People in Shipping |

| Philanthropy | Supporter of Greek Orthodox Church, Patriarchate |

| Controversies | Legal issues in oil smuggling |

Creating an Empire in Shipping and Oil

Melissanidis started his profession in a little driving school in 1975. He started Aegean Oil in 1995, and it grew to be among Greece’s biggest petroleum firms. He also founded Aegean Marine Petroleum Network, now ranking as the second-largest independent gasoline provider worldwide.

Important Corporate Results

Aegean Marine Petroleum Network developed quickly under his direction. The organization offers bunkering services all around. 2016 saw Mel Nissanidis sell his AMPNI shares. Still, he is a major player in world shipping and keeps active in the oil sector.

Rebuilding AEK Athens F.C.

In 1992 Melissanidis replaced AEK Athens F.C.’s manager and guided the team through a great run. The squad competed in the UEFA Champions League and two titles were won under his administration. He came back in 2013 to help the club escape debt and turn its fortunes around.

Vision for New Stadium for AEK

Development of a new stadium for AEK Athens was one of his main efforts. Inspired by Hagia Sophia, the stadium hosts more than 30,000 spectators. The endeavor generated employment and strengthened the local economy. Modern elements mixed with historical connotations define the design.

High-stakes corporate deals

Emma Delta bought OPAP, the biggest betting company in Europe, mostly thanks to Melissanidis. With the $652 million agreement, Greek privatization initiatives underwent a sea change. Later on, he sold his 2022 share, making EUR 327.4 million, therefore confirming his financial success.

Legal Concerns and Conflicts

Melissanidis has been in controversy notwithstanding his successes. Conflicts of interest at OPAP and claims of oil smuggling have tarnished his career. He provides refutations of several of these assertions. Legal disputes involving his companies still shape his public story.

Community Projects and Philanthropy

Melissanidis has been a friend of the Ecumenical Patriarchate and the Greek Orthodox Church. He received the title Kouropalates in 2014, a distinction not awarded since the fifteenth century. His contributions also include support of neighborhood projects and local charities.

Awareness in Shipping

Lloyd’s List placed him 97th among the most powerful individuals in the maritime industry in 2015 Globally, his creative approaches in fuel supply and logistics brought him recognition Melissanidis is still a major actor in determining the direction of the shipping sector.

Current Changes

For €90 million Melissanidis sold his AEK Athens shares to shipowner Marios Iliopoulos in 2024. This signaled his resignation from club leadership. Though he is no longer involved in football, his commercial interests in shipping and oil keep flourishing.

FAQs About Dimitris Melissanidis Net Worth

- What is Dimitris Melissanidis’ net worth?

His estimated net worth is $3.4 billion. - What businesses is he involved in?

He owns Aegean Oil, Aegean Shipping Enterprises, and previously OPAP shares. - What is his role in Greek football?

Melissanidis is a former president of AEK Athens F.C., known for revitalizing the club. - Has he faced controversies?

Yes, he has faced legal challenges related to oil smuggling and business practices. - What is his philanthropic work?

He supports the Greek Orthodox Church, Ecumenical Patriarchate, and local communities.